Contents:

- All You Need to Know About Business Brokers

- What Does Business Broker Mean?

- Business Skills 101 in 2023

- What Services Does a Buyer’s Representative Provide?

- Transworld Business Advisors will advocate for you during the process with our buy side representation program.

- Experience in Completing Transactions

Hard Assets– These are tangible assets consisting of furniture, equipment, property fixtures owned by a company. Another type of asset is called an intangible asset; it does not have these characteristics. CBI –Certified Business Intermediary is a credential issued by the International Business Brokers Association and / or its affiliated organization Mergers & Acquisitions.

- M&A advisors are often investment bankers that work on a national or even global scale, handling complex deals and sales spanning multiple locations.

- Well, just like a house, you can ask each of these questions about your business and whether taking the sale into your own hands would really be to your benefit.

- The main value a business broker can bring is to act as the buffer between the buyer and seller.

- We decided to put our machine shop, a family business of 46 years, up for sale in 2019.

A business broker usually wants to get involved early in the process of a planned company sale to take measures to increase the company’s market value and/or to facilitate and speed up the sales process. Business brokers have traditionally been compensated by the seller with a commission only fee arrangement which is detailed in a listing agreement and paid at closing. However, in recent years some brokers have moved to a partial up front fee which may be credited to commission at closing. Business brokers can represent either the buyer or seller in a sale. Historically, the broker has traditionally represented the seller, but buyer representation is becoming more common. The representation of one party in a transaction usually creates a fiduciary duty between the broker and the party represented.

All You Need to Know About Business Brokers

Drawing in Buyers – Aside from the brochures, business brokers also have the know-how and contact to entice buyers. The established brokerages have vast databases of potential buyers and can send out business-for-sale alerts to their contacts when there is a new business listing. The services and time investment required to sell a business varies greatly depending on the business and challenges that might be unique to selling a particular business.

It may be lacking in some areas, but it might also have some pluses to seriously consider. There is an old adage that says, “The first offer is generally the best one the seller will receive.” This does not mean that you should accept the first, or any offer — just that all offers should be looked at carefully. When you and the buyer are in agreement, both of you should work to satisfy and remove the contingencies in the offer. The buyer may, at this point, bring in outside advisors to help them review the information. When all the conditions have been met, final papers will be drawn and signed. Once the closing has been completed, money will be distributed and the new owner will take possession of the business.

What Does Business Broker Mean?

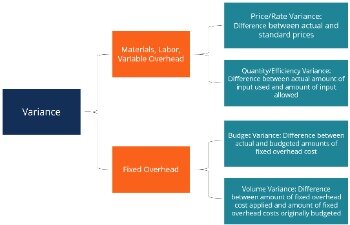

Without a business broker by their side, it can be difficult for business owners to place a realistic valuation on their business. For buyers, they may end up acquiring a company that was priced above its correct value. Typically, business intermediaries are paid a fee which is typically a percentage of the sale price.

- Annual revenue – If you want to sell your business, the company’s annual revenue will be one of the first requests on any valuation form.

- They will help you find the right buyer and get the best price for your company.

- A business broker will also protect the confidentiality of the businesses by requiring interested buyers to agree not to disclose any details of the prospective business sale.

- If you’re thinking about selling your company during these unprecedented times, you’re not alone.

- The seller is the brokers client, and any buyer who comes to the table is a customer.

Some states allow dual agency representation of both buyer and seller if all parties agree to the arrangement. Business Brokers set the rate to charge for their firms, but they seem to stay pretty much the same. Ten percent (10%) is the normal rate, but it can be higher or lower depending on the individual brokerage or the type of business being sold. This fee is based on the total purchase price and is paid to the Broker at Closing. The Listing Agreement For The Exclusive Right To Sell signed by the seller will explain the fee in detail.

Business Skills 101 in 2023

We would ask the buyer about any experience they have with coffee shops. Maybe we learn that they managed one for five years and they know all the ins and outs for how to manage a coffee shop properly. This information would be great to know if we happened to find a coffee shop for sale that’s performing ok, but we learn the management is doing a poor job. Now we’ve found an inefficiency that the buyer can easily improve on to increase revenue in the short term. Earn-out– A method of calculation payment for the business based on future performance of the business.

This type of business broker definition is very complicated, and it is far different from selling a car or even selling a home. There are a lot of steps that must be taken, and there are numerous potential pitfalls that could mess things up. In addition, some brokers may charge an hourly rate or a flat fee. Be sure to ask about all fees upfront so there are no surprises later on.

In this article, we take a closer look at what the meaning of a business broker is and what they actually do. Stockbrokers are regulated professionals, usually working with a broker-dealer or brokerage firm. These dealers and firms buy and sell stocks and other financial securities.

What Services Does a Buyer’s Representative Provide?

Working Capital– This is calculated as current assets less current liabilities. Working capital is used to finance the sales cycle of a business, which is the time required to convert raw materials into finished goods, finished goods into sales, and accounts receivables into cash. Some businesses, such as restaurants, do not require much working capital.

Tail period,” in which the https://trading-market.org/ is entitled to their fee if the business sells within a certain period of years after the listing contract expires. Main Street intermediaries often have listing agreements for six months to a year, because it takes a shorter amount of time to sell a smaller business. Business brokers have a number of National, Regional and local Associations in the United States that provide education, regulatory and annual conferences for its members. One of the largest is the IBBA which has over 500 business broker members across the United States. The use of a business broker is not a requirement for the sale or conveyance of a business in most parts of the world.

Transworld Business Advisors will advocate for you during the process with our buy side representation program.

Business Brokers are paid a success fee for finding buyers who make offers to buy and then actually buy your business. If they bring only one buyer to you and they are not engaged to find multiple buyers, you may want to consider negotiating a lower ‘finder’s fee’, if the business is actually sold to their buyer. Listing –A written agreement between a principal and an agent or broker authorizing the agent or broker to perform services for the principal involving the principal’s property . Generally, the services provided by the agent or broker involve the proposed sale of the principal’s real estate or business. Also, the property or business listed by the agent or broker is called a Listing.

There are a few different types of stockbrokers, though, and each has its advantages and limitations. For example, discount stockbrokers manage trades and take a low commission on the deal, but they cannot provide financial or investment advice due to having different licensing and registration. Also known as information brokers, data brokers are individuals or companies that collect data from various sources. Data brokers then sell or license the data to third parties, like advertising companies.

Commodity brokers execute orders to buy-sell commodity contracts on behalf of clients. In other words, if you tell the broker to buy, they will buy on your behalf. Cargo brokers, shipping agents, or port agents are responsible for handling shipments and cargo.

Some businesses will take longer to sell, while others will sell in a shorter period of time. The sooner you have all the information needed to begin the marketing process, the shorter the time period should be. It is also important that the business be priced properly right from the start. Some sellers, operating under the premise that they can always come down in price, overprice their business. This theory often “backfires,” because buyers often will refuse to look at an overpriced business.

Experience in Completing Transactions

Others, meanwhile, might prefer to trim down these costs, perhaps by hiring a broker to just handle the final negotiation phase. Usually, the smaller the transaction, the larger the commission. “Main Street” businesses, those with enterprise value between $100,000 and $1,000,000 can expect commissions to average between 10-12%. Commissions are determined between the client and their broker and are normally paid at closing.

Interactive Brokers Unveils New Feature to Help Clients Achieve Even Better Price Execution on US Options Trades – Yahoo Finance

Interactive Brokers Unveils New Feature to Help Clients Achieve Even Better Price Execution on US Options Trades.

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

For the buyers, a broker can present to them motivated sellers and opportunities that meet their particular skills set, passions, and financial objectives or goals. Agency relationships in business ownership transactions involve the representation by a business broker of the selling principal, whether that person is a buyer or seller. The principal broker (and his/her agents) then become the agent/s of the principal, who is the broker’s client. The other party in the transaction, who does not have an agency relationship with the broker, is the broker’s customer.

What Is An Investment Broker? – Forbes Advisor – Forbes

What Is An Investment Broker? – Forbes Advisor.

Posted: Wed, 29 Jun 2022 07:00:00 GMT [source]

Once a buyer knows the name of a business for sale, there is no guarantee that they will keep it confidential. “Co-brokering in business sales is unfortunately one of the most confrontational and contested subjects in the business brokerage industry”, Jim Parker, President, Business Brokers of Florida . Transworld Business Advisors globally, has a philosophy of co-brokering, but that is not true of most business brokerage firms. One-sided interests – It is standard that a business broker represents the seller. If you are the buyer, the appointed broker may not be fully aligned with your best interests. Although most brokers will be supportive of both parties, it is worth keeping in mind that the broker may hold more loyalty to the seller.

Like business brokers, M&A Advisors guide businesses through the complicated world of mergers and acquisitions (M&A). Outsourcing this complicated legwork to professionals should ensure that a satisfactory deal is concluded seamlessly. It adds value, too, enabling the business owners to continue to focus all their energies on day-to-day operations without getting distracted and bogged down with other dilemmas. Among the various challenges that must be overcome include determining a fair valuation, making sure the company’s finances and accounting records are in order, negotiating a price, going through escrow and closing the sale. Develop a comprehensive Information Memorandum on the company; normally a page document outlining the business for potential buyers. The last step of the business broker involvement is the assistance with the due diligence and exchange of relevant information after the conditional offer has been signed by both parties.

So being able to communicate with people, having good people skills, and having the initiative to seek out new customers are all vital to being a great broker. Businesses by adding value to their brands, developing content marketing strategies, as well as educating and connecting with their audiences on a personal level. Insurance brokers or insurance agents sell, solicit, or negotiate insurance for compensation. A broker also has the resources and tools to reach the widest possible base of buyers. They screen these potential purchasers for revenue that would support the potential acquisition. Yes, most states require that both parties agree to a dual agency arrangement.

Efficient information exchange is essential in assuring that deal momentum is maintained and parties are given the necessary next steps in a relevant and coherent order. A broker’s main role in the deal, whatever side they are on, is to assist the parties through the process. They understand the steps that it takes to get to the finish line. Buying or selling a business is a complex process – and you shouldn’t go through it alone. You need an experienced business broker to guide you through the process. An M&A advisor is different from a broker in that they are more focused on the financial side of the deal.